All Categories

Featured

Table of Contents

: Annuities can offer guaranteed earnings for life. Annuities do not. Because they're invested in a different way, annuities commonly use a higher ensured price than other items.

You pay tax obligations when you receive your annuity income, and no one can predict what the taxable rate will be at the time. Annuities can be hard to understand.

Are Fixed-term Annuities a safe investment?

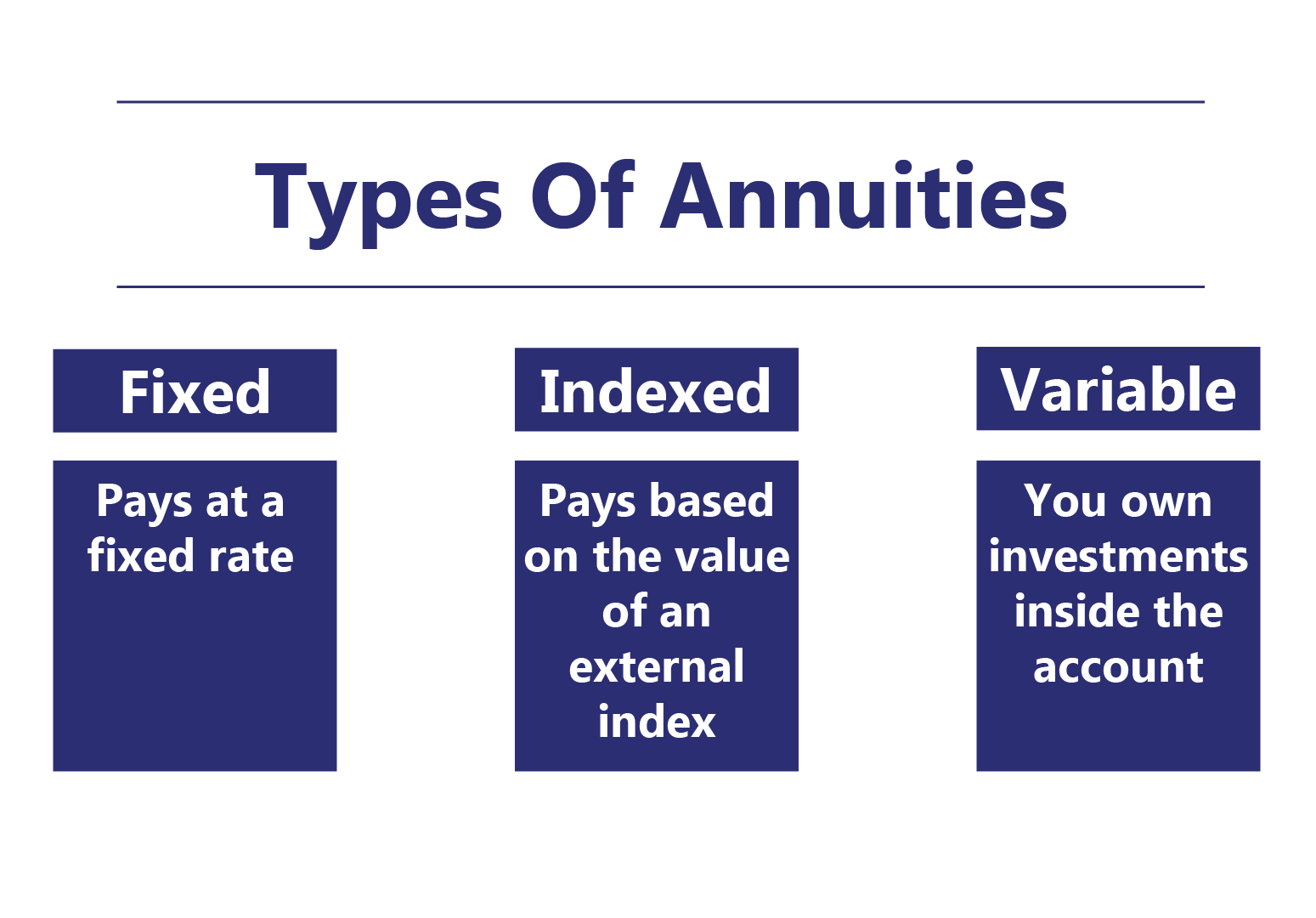

Deposits into annuity contracts are normally secured up for an amount of time, where the annuitant would certainly sustain a fine if all or component of that money were withdrawn. Each sort of annuity has its very own special benefits. Figuring out which one is ideal for you will depend upon factors like your age, threat resistance and just how much you have to invest.

This product is a blend of its fixed and variable family members, and that makes it a little bit a lot more difficult. The interest rate paid to annuitant is based upon the performance of a defined market index. With an indexed annuity, you have the chance to earn greater returns than you would certainly with a fixed annuity with even more defense versus losses than with a variable annuity.

How do I cancel my Immediate Annuities?

As a result of their complexity, the choice to buy an annuity is one you should review with an expert. Currently that you recognize what an annuity is, contact your local Ranch Bureau representative or advisor to recognize your choices and produce a retirement approach that helps you. An annuity is an agreement with an insurance policy business that gives tax-deferred passion and the potential for an assured stream of income. Purchasing one can aid you feel a feeling of monetary protection in retired life - Guaranteed return annuities. There are also a number of other advantages to take into consideration. One benefit to annuities is the reality that they can offer guaranteed revenue for a set variety of years, or perhaps for the rest of your life.

In truth, in these situations, you can think of an annuity as insurance policy against possibly outliving your cost savings. For employees who do not receive a pension plan, an annuity can aid load that space. Employees can spend money right into a retired life account (like an IRA) and afterwards, upon retired life, take those financial savings and buy an annuity to supplement Social Security.

Who should consider buying an Annuity Accumulation Phase?

An additional big benefit provided by annuities? All qualified annuity withdrawals are subject to normal income tax, and withdrawals taken prior to the age of 59 will certainly incur an extra 10% tax fine The tax-deferred standing can enable your cash to have even more growth potential or permit your cash to potentially grow more over time due to the fact that gained rate of interest can compound without any funds requiring to go toward tax payments.

Unlike other retired life choices, there are no internal revenue service restrictions on the quantity of money you can add to an annuity. The IRS areas caps on the quantity you can purchase an IRA or 401(k) each year. For instance, the 2024 restriction for an IRA is $7,000 a year or $8,000 if you're 50 or over.

What is the process for withdrawing from an Flexible Premium Annuities?

:max_bytes(150000):strip_icc()/Immediate-variable-annuity.asp-final-c62d88ef3f7a4b688c0303ef04e1fbce.png)

1 However the IRS does not put a ceiling on the quantity you can add to an annuity.

For instance, there are prompt annuities and delayed annuities. What this suggests is you can either buy an annuity that provides settlement within a year of your costs or an annuity that begins paying you in the future, commonly upon retirement. There are additionally annuities that grow at a fixed price, or variable annuities that expand according to the performance of investments you have in a subaccount.

Rider advantages, terms and conditions will certainly differ from motorcyclist to rider. Lasting treatment insurance policy can be expensive or hard to obtain for those with pre-existing conditions or health worries. However, this is a location where annuity benefits can use proprietors a benefit. With an annuity, you may have an option to acquire a rider that allows you to receive greater settlements for a set time period if you require lasting treatment.

It's only a guaranteed amount of earnings you'll receive when the annuity enters the payment phase, based on the claims-paying ability of the insurance company. With any type of economic choice, it's good to know and evaluate the costs and benefits. If you want to know what are the benefits of an annuity, remember it's a feasible choice to save tax-deferred money for retired life in a method that suits your needs.

How can an Income Protection Annuities help me with estate planning?

Most individuals pick to begin obtaining these settlements either at or sometime after retired life - Income protection annuities. Annuities have an entire host of names, based upon advantages and providing companies, but at their core, they are best recognized by their timeline (immediate or deferred) and whether they consist of market exposure (variable). An immediate annuity lets you quickly turn a swelling amount of cash right into a guaranteed stream of revenue.

Table of Contents

Latest Posts

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Stra

Analyzing Immediate Fixed Annuity Vs Variable Annuity Key Insights on Annuity Fixed Vs Variable Defining Fixed Vs Variable Annuity Benefits of Choosing the Right Financial Plan Why Choosing the Right

Highlighting the Key Features of Long-Term Investments Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Retirement Income Fixed Vs Var

More

Latest Posts